MEMO

:

ORIG DATE : 12/30/2009

LAST

REV

:

TO

: RCC Customers with Payroll

FROM

:

SUBJECT

: 2010 RCC Payroll Tables

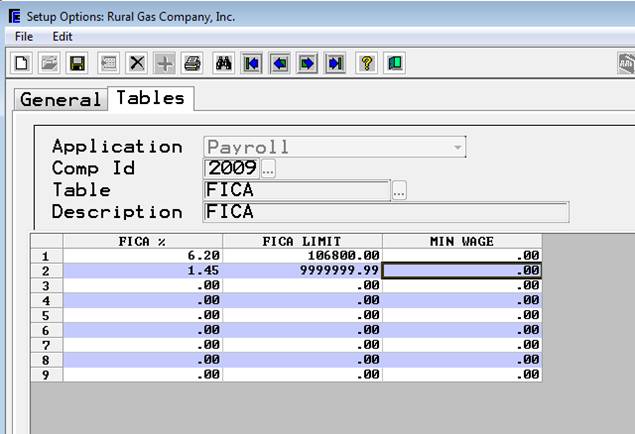

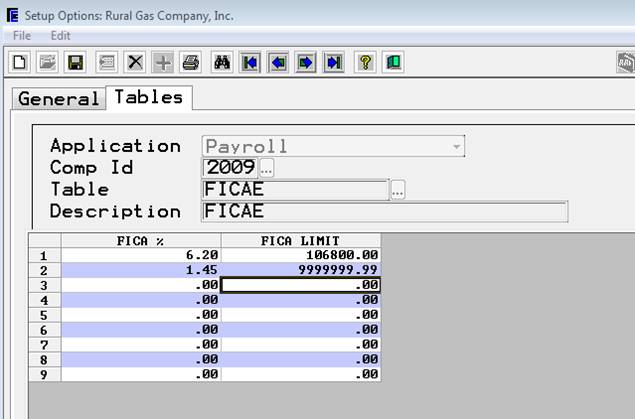

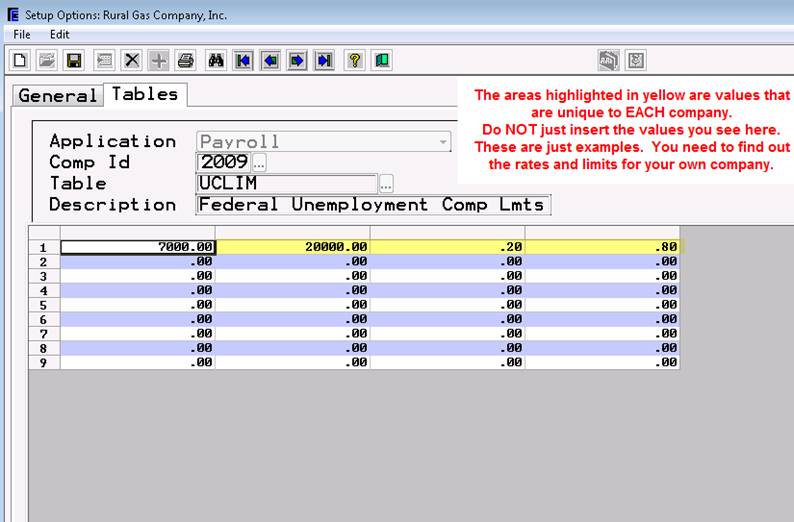

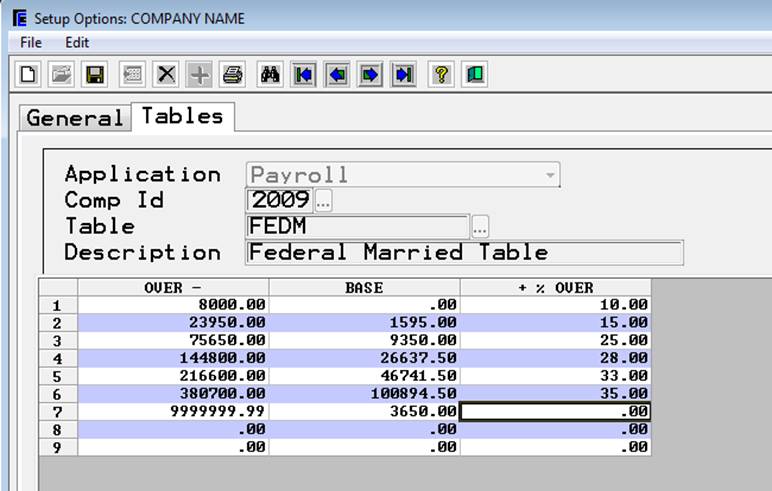

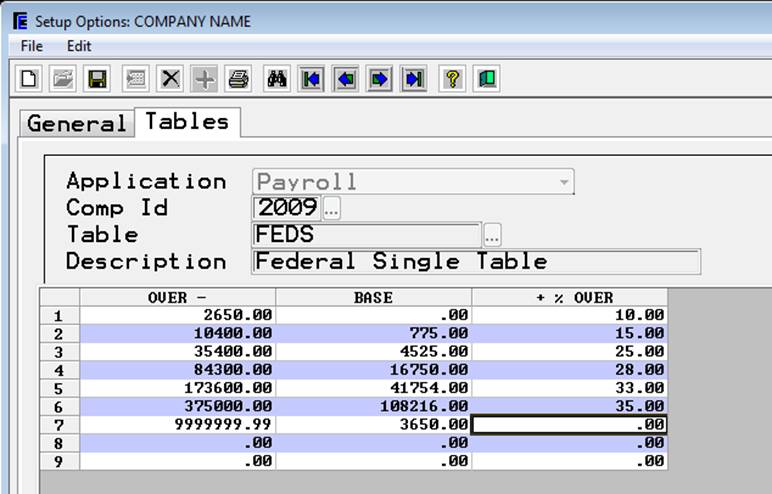

Below are the tables you will need to change in the RCC Payroll package if you are using it to do your payroll.� You will also need to check your STATE circular to see if your State limits have changed and make the appropriate changes to those payroll tables.� Because the tables now carry a �year� in the �comp id� field, these tables can be added right away.�� The system will start using the 2009 tables for payroll checks generated in 2009. For federal changes, please make your tables look like the following. �Unless you are on an old version of RCC, you will find the payroll tables in �Utilities > Setup Options�, on the �Tables� tab.� Once on the �Tables� tab, be sure to select �Application� of �Payroll� and then add the new tables by typing in the year and then typing in the table name.� �Any questions please call our support staff and they will be pleased to lead you through it.�

Thank You.

Susan Peterson

Support Manager

For the xUCLIM table, the �1� in the first position is the company number you are using.� Remember to reset this table for EACH company #.� The State UC Limit may be different for your state.� The State % is different for each company, insert the value that has been assigned to your company.� The Fed % rate is different for each company, insert the appropriate value.

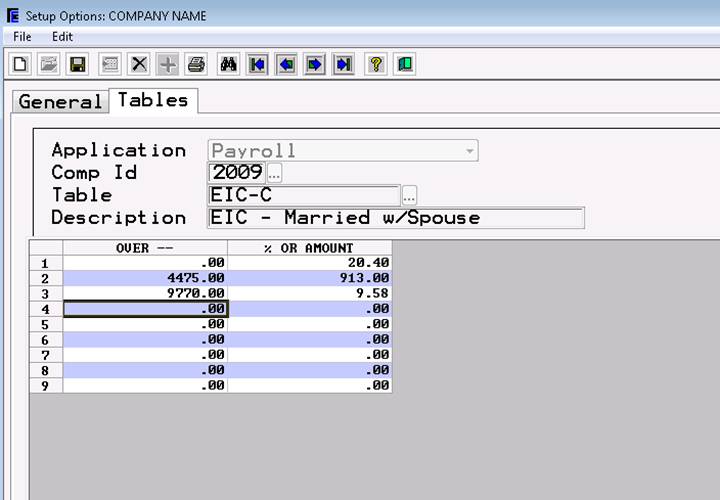

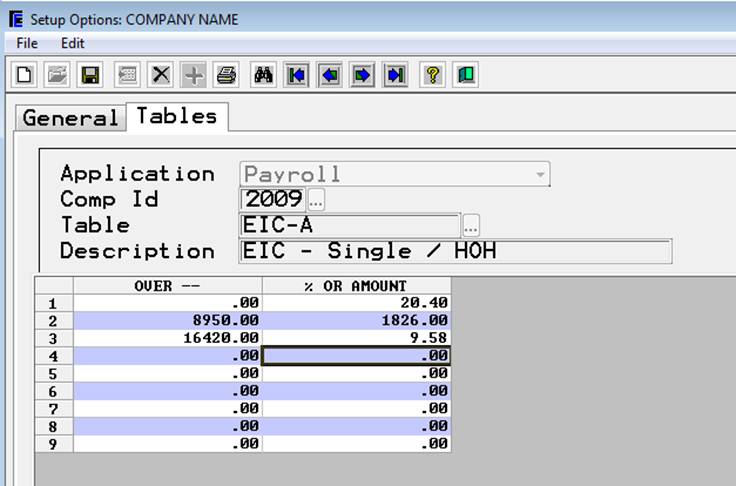

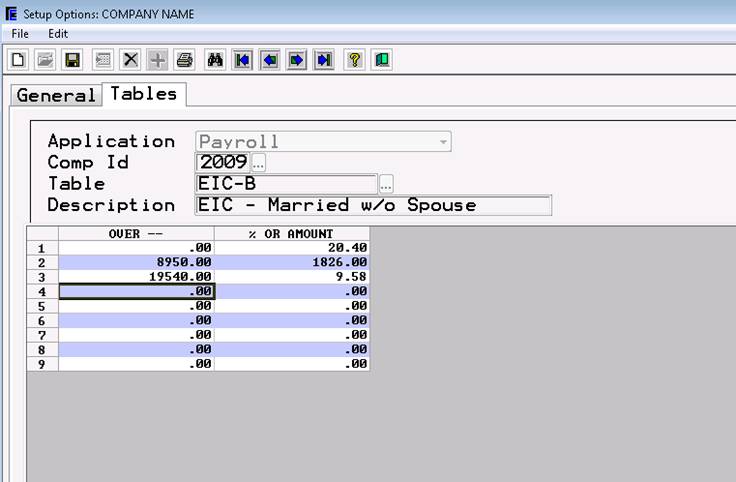

IMPORTANT:� The following tables are NOT required in the system.� You will only

need to change the tables if you have a staff member using the Advanced Earned

Income Credit logic. IF you do not have the following tables setup, then you

are not currently using this function and you are NOT required to add them.

IF you have any employees using Advanced Earned Income Credit these are the tables for 2008.� It is not necessary to setup the following tables if you have no employees using AEIC.

y